Child Tax Credit 2024 Phase Out Worksheet – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . What to expect for 2024?. The child tax this credit. Understanding these changes and qualifications can help taxpayers effectively plan for their financial future. Don’t miss out on all .

Child Tax Credit 2024 Phase Out Worksheet

Source : turbotax.intuit.com

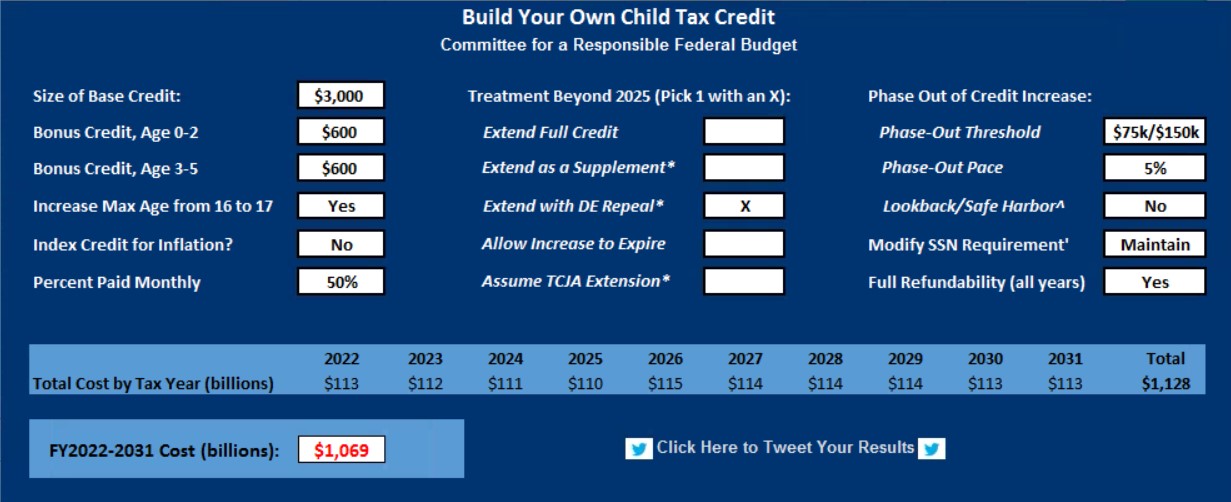

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

The Federal Earned Income Tax Credit, Explained | by Maryland

Source : medium.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Will You Get a State Child Tax Credit Payment in 2024? Find Out

Source : www.cnet.com

2023 2024 Child Tax Credit: What Will You Receive? | SmartAsset

Source : smartasset.com

Child Tax Credit 2024: How Much You Could Get and Who’s Eligible

Source : www.cnet.com

What is the Additional Child Tax Credit? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024 Phase Out Worksheet 2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax : With the 2024 tax qualifying child. The credit phases out for single filers with income above $29,500 and $35,000 for taxpayers filing jointly. New Jersey: The New Jersey Child Tax Credit . will start to see the value of their credit decrease and eventually phase out. In Massachusetts, taxpayers who care for a child or elderly parent can claim a tax credit that is worth $440 for each .